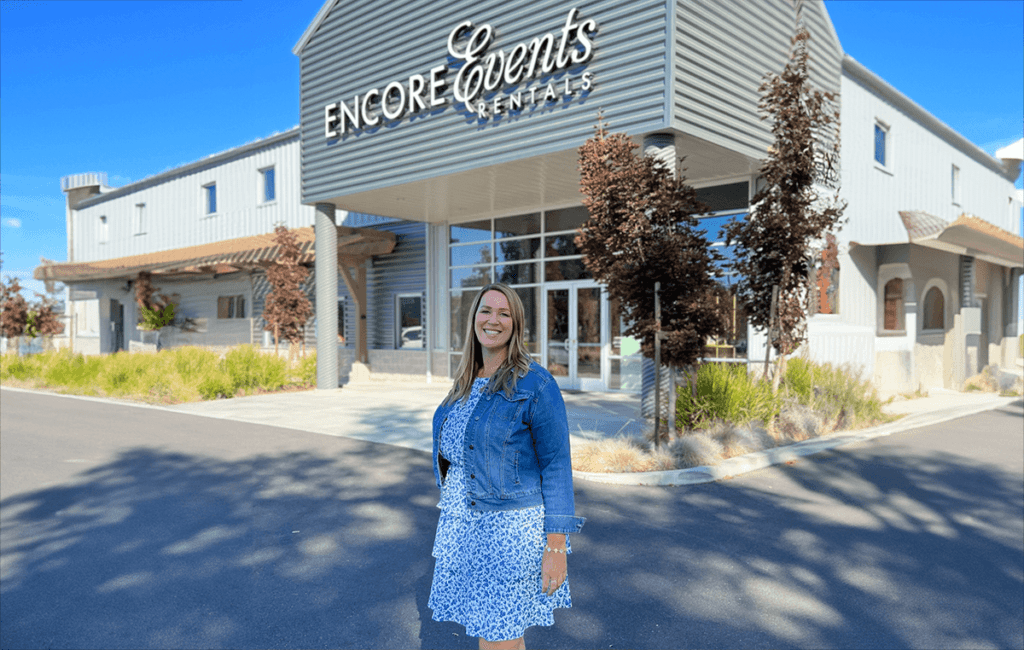

Bridget Doherty is the co-owner and president of Encore Events Rentals, a premier events rental company in Northern California, with three locations serving Wine Country and the San Francisco Bay Area. She is also the co-owner of Cal-West Rentals, a full-service heavy equipment company. She’s been an entrepreneur for 24 years and a Founder for nearly 14. We talk to Bridget about the difficulties she faces along the way and her coping strategies.

Overcoming Hurdles and Growing Your Business

After 24 years in business, Bridget has experienced her fair share of peaks and valleys. We asked her about the most difficult challenges her business has faced, and how they overcame them.

“We’ve had a variety of struggles. All the sad, hard stuff that happens when you work with a large team. COVID was highly impactful for Encore because our business is based on people gathering. We went from 100 employees to 4 in one day. That’s up there in the top five most challenging moments.

“Personally, the biggest difficulties have come when some of our employees have had issues, whether at work or outside. As the leader of the company, you have to guide people through crises. You have to find space and energy for it. That’s one thing I have gotten comfortable with. Certain parts of my personality and traits lend themselves well during those times. Practice also helps you work through those hard times.”

Even though you inevitably build confidence with time, as a leader, you don’t always have to face the current alone. Having a team behind you can ease the burden and the stress of the challenges.

“We have a great senior management team. I’m also a huge proponent of business groups within your industry. When I first took over, I knew nothing about business or equipment rentals (see her Founder story for more). A few years in, by the time I was 25, I had connected with The Business Analysis Group. It’s a small group that meets twice a year. During the meetings people discuss all things related to business, finance, best practices, challenges, bonus structures, whatever you want to talk about. I’ve been in one of those groups for 20 years now.”

All You Need is the Right Community

Networking is one of the key pillars of business. If you don’t have the what or how, i.e. if you don’t know or you can’t do something, the next step is the who: find someone who can help you figure out where to get the information or how to do it. For Bridget, the missing link was getting involved in business groups.

“I joined EO (Entrepreneurs Organization) when I was in my late 20s, early 30s. It was part of my San Francisco chapter. I was still learning from other entrepreneurs and business owners. It doesn’t matter what industry you’re in, a lot translates across the board. I’ve always been a proponent of connecting. Business owners can feel lonely and isolated, especially when times are toughest. But other people in the same position understand.”

Finding the best group for you can be tricky to start with, but the effort you put into finding that right fit will pay off. Formal and informal mentorship opportunities or mastermind groups are available in every region around the globe. There are also industry- and niche-specific groups, however, only opting for these might limit your perspective. Gaining exposure to fellow Founders outside your industry offers great learning opportunities too and a different point of view. Additionally, the more formal (paid) groups offer different tiers depending on how mature your business is.

“I moved groups a few times: first, when I stopped focusing on equipment, and later on, when we grew, I moved to a bigger group. It’s been a great resource for ideas from other business owners that I trust in a time of crisis. And it continues to be immensely beneficial.”

Industry Associations are also quite underrated and unutilized. They are an amazing resource you can tap into knowing that they have at least a more than basic understanding of your work and who to connect you with.

Advice on Scaling and Financing Your Business

Apart from groups, Bridget is also part of external boards and communities.

“I just got off the board of Corazón Healdsburg, where I was for the last six years. It was a big focus of mine, an organization that appeals to my values and I believe in immensely. In general, we at Encore are very involved in the local community. That’s also a perk of what we’re able to do. We have grown to support others by donating financially or providing our rentals.”

Despite having opportunities to expand to additional markets, Bridget and her team have decided to stay local to stay involved in the local communities. Generally, we ask her about this choice of hers and her approach to scaling up the business.

“When I was 30, there was only so much scaling I could have done with the hours I worked. There are only so many hours in a day and so much the team can do. Scaling up is truly a team effort. We focused on Sonoma and Napa Counties. We continue to grow there: we opened a showroom six months ago in Napa, which was a new location for us.

“We haven’t pursued anything outside of Sonoma County and Napa County, because there’s a fine line of how much to keep scaling. When the business was smaller, we had years with 40-50% growth. But as we become larger, we cannot grow at this rate and keep our current structures. We also haven’t taken the approach of buying smaller rental companies and integrating them into the business. This is how the majority of businesses in our industry grow. I’m open to it because I want to continue developing Encore but it’s also not a strong directive for me. I want to be able to provide more opportunities for my team. For me, this is the biggest growth, not the financial side. I understand the incentives are different for everyone, and this is mine.”

Business growth shouldn’t happen just for the sake of growth. It should be aligned with the company values and fit the long-term vision of leadership. There are many ways to mature a company, and increasing staff or profit margins is not all there is.

The second biggest obstacle to business growth is the lack of resources. Business owners resort to seeking debt funding or external investment to navigate this. In fact, 63% of businesses have accessed debt funding [1]. But curiously, only 27% of female-led businesses have sought funding or investment [2]. Bridget’s company supports the data.

“My brother and I have figured things out alone over the years. We have had struggles but have worked through them. Having somebody else weigh in was never anything we were interested in.

“We don’t have any outside investors. I didn’t want to relinquish that control. We used the credit line, especially when we were smaller. Our business is seasonal so the first quarter is always slow. Instead of losing sleep for endless nights, because we’ve had such moments, the credit line gives you a security blanket should you need it.”

Bridget’s ability to listen to her gut and her clarity on how she wants to show up to lead her company has guided her through the ups and downs over the years. For more stories and advice, follow us on Follow the Founder. You can also find us on Instagram or LinkedIn.

References:

[1] Fifth of businesses unaware of funding options, consultancy.co.uk

[2] 47+ Women in Business Statistics, bizee.com

Want to Keep Reading?

Secrets of the Millionaire Mind: T. Harv Eker

How financial success is shaped by subconscious money beliefs and offers strategies to rewire one’s mindset for wealth and prosperity.